It’s a tough time to search for work in America, and lots of Individuals are trying. Over 45% of Individuals earn more money by working a facet hustle. A lot of the Individuals who do work a facet hustle work an additional 12-hours on high of their main job. And even in any case of that additional work, many Individuals barely make half of their main month-to-month earnings with a facet hustle.

If you’re getting cash from a facet hustle, and wish to put it aside for the long run, then strive financial savings bonds.

Financial savings Bond

Are you in search of a very good place to stash the financial savings you generate from a facet hustle? Then a financial savings bond could also be a very good wager for you.

A financial savings bond is a U.S. authorities debt safety. In different phrases, whenever you purchase a financial savings bond you might be loaning the American authorities cash to run its operations.

And identical to a standard bond, a financial savings bond is just about assured to payout when wanted. So long as the American authorities exists, your return on funding in a financial savings bond is very prone to be repaid.

A financial savings bond is much like a standard Treasury bond as an funding car however has a number of distinct variations.

Not like a standard Treasury bond, a financial savings bond solely pays curiosity after it’s redeemed.

A coupon fee refers back to the rate of interest that’s credited in opposition to a bond over time. For instance, a standard Treasury bond is credited with curiosity twice a 12 months. A financial savings bond positive aspects incremental quantities of curiosity every month.

Not like a Treasury bond, which pays out the curiosity that it accrues whenever you money it out, a financial savings bond doesn’t. You could wait a couple of 12 months earlier than you possibly can money out a financial savings bond.

And in case you money out a financial savings bond earlier than a interval of 5 years, then you definitely lose the final three relevant months of curiosity.

Taxes on a financial savings bond should not paid till the bond is redeemed. Taxes are paid by way of curiosity funds with most conventional bonds. And taxes on financial savings bonds are paid solely on a nationwide stage.

The most important distinction between a standard bond and a financial savings bond is {that a} financial savings bond nonetheless exists after its maturity date.

Varieties of Financial savings Bonds

There are principally three sorts of financial savings bonds, nonetheless, solely two nonetheless at the moment exist.

The Sequence E financial savings bonds have been first created Throughout World Conflict II to assist fund the conflict effort. Sequence E financial savings bonds have been phased out of circulation in 1980 and are not issued.

Moreover, in case you personal a Sequence E financial savings bond, you possibly can nonetheless money them in, however they stopped gaining curiosity in 1980.

The Sequence EE financial savings bond have been first circulated in 1980 and develop into the direct alternative for the Sequence E. Sequence EE financial savings bonds are nonetheless issued now.

Moreover, in case you purchased an digital Sequence EE bond after June 2003, the U.S. Treasury ensures that you may redeem it for twice its face worth. And in case you maintain onto an digital Sequence EE bond issued in June 2003 or afterward for not less than 20 years, it’s going to earn an annual rate of interest of three.5%.

The Sequence I financial savings bond supply an enhanced stage of safety in opposition to inflation relative to the Sequence EE saving bond. And all Sequence I financial savings bonds supply a hard and fast fee or variable fee rate of interest primarily based on the Client Worth Index.

You should purchase financial savings bonds for any quantity between $25 to $10,000 inside a 12-month interval.

And you’ll solely money in a financial savings bond as soon as it’s not less than 12-months outdated. Additionally, in case you money in a financial savings bond earlier than its five-year maturity, you’ll lose not less than three months of curiosity.

The Sequence EE and Sequence I financial savings bond for a interval of as much as 30-years. If you’re saving cash from a facet hustle, you should utilize a financial savings bond as a long-term technique to maintain it.

Nevertheless, one main downside of the financial savings bond is the rate of interest.

Financial savings Bond Curiosity Charges (And different Drawbacks)

Financial savings bonds are a good way to save cash that was hard-earned from a facet hustle. Nevertheless, the largest main downside of investing in financial savings bonds is that they generate minimal curiosity.

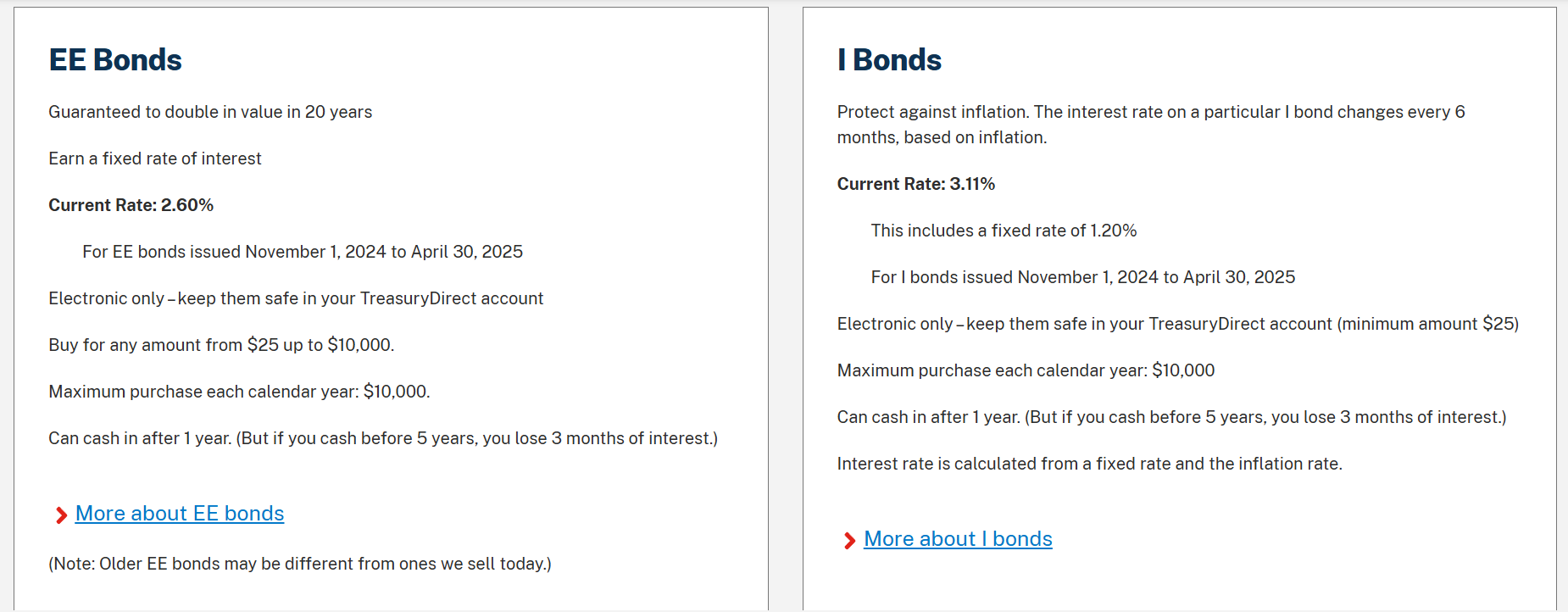

At the moment, Sequence EE financial savings bonds solely supply a 2.6% rate of interest. And the Sequence I financial savings bond at the moment gives a 3.11% rate of interest – nonetheless, that rate of interest can differ in keeping with the Client Worth Index. Listed below are the present charges from the treasury.

You may get the most recent charges right here.

Financial savings bonds are inherently non-transferable, and you can’t promote them to others. When you purchase an digital Treasury bond, you possibly can switch it to a different particular person’s account.

Nonetheless, when you have a long-term financial savings technique in thoughts, saving cash from a facet hustle in a financial savings bond is an efficient method to go.

Facet Hustle Technique

Paper financial savings bonds could be cashed at banks, check-cashing facilities, and different monetary establishments. When you purchase digital financial savings bonds at TreasuryDirect.gov, then you possibly can credit score the cash in your account after which switch it to a checking account.

It isn’t straightforward to work a facet hustle on this pandemic-wrecked economic system, so think about each choice attainable to avoid wasting extra of the cash you earn.

Learn Extra

What Is the Minimal Wage In Denver, Colorado

Want Some Cash Making Concepts? Right here Are 38 You’ve By no means Heard Of.

Allen Francis was an instructional advisor, librarian, and faculty adjunct for a few years with no cash, no monetary literacy, and no accountability when he had cash. To him, the phrase “private finance,” incorporates the ability that anybody has to develop their very own wealth. Allen is an advocate of finest private monetary practices together with focusing in your wants as an alternative of your needs, asking for assist whenever you want it, saving and investing in your individual small enterprise.